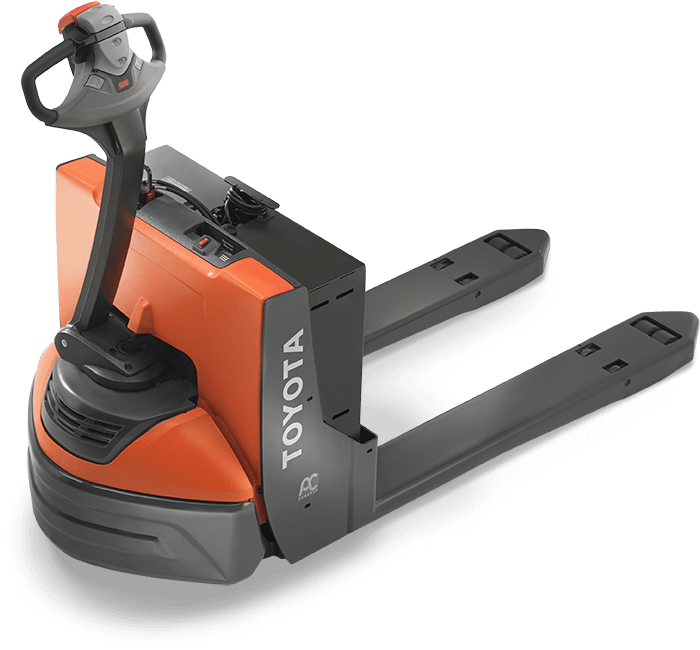

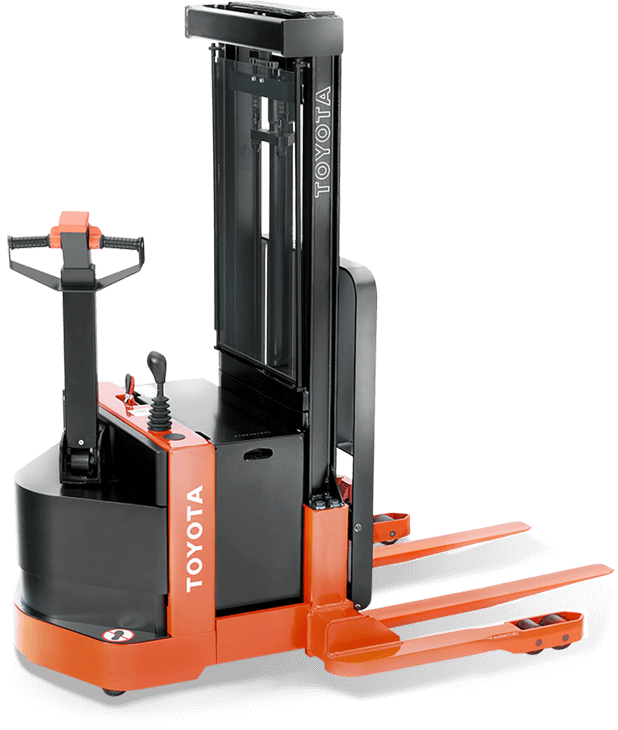

IRS Section 179 continues to be a great tax-saving tool for U. S. businesses.

IRS Section 179 allows businesses to deduct the cost of certain qualifying equipment, such as forklifts and other material handling equipment in the year of purchase instead of traditional depreciation taken over several years. The limit for this deduction is $1.5 million in 2021.

We recommend discussing the tax benefit with your

financial or tax advisor before purchasing

equipment.

Nationwide

Nationwide