Financing your forklift?

Let Toyota Industries Commercial Finance Become Your Forklift Financial Partner!

Toyota’s finance company offers a variety of loan and lease products and programs to help get you the equipment you need at an exceptional value. And no one understands forklift equipment financing like “TICF”, which allows them to deliver you the best options and rates!

Flexible Financing Options…

A RETAIL INSTALLMENT LOAN, the “traditional” financing of the purchase of equipment, is the perfect alternative to paying cash, while allowing full responsibility of ownership.

A CLOSED-END “OPERATING” LEASE allows you the right to use the equipment typically without the full cost of ownership. (In addition to other amounts, lease payments take into account an end-of-term residual value, which help reduce the monthly payment). It also offers you cash management flexibility in the structuring of lease payments, and… lease payments may be deductible for federal income tax purposes.

A CAPITAL LEASE (Bargain or $1.00 Purchase Option) is a lease with characteristics of a purchase agreement, typically providing for a purchase option at nominal or below-market price or providing a very minimal residual (also known as a Conditional Sales Lease). It’s an alternative to paying cash and to a Retail Installment contract, while providing the ability to purchase the equipment at the end of the lease for a nominal amount.

Toyota Industries Commercial Finance (TICF) makes it easy and affordable to get the right equipment for the job!

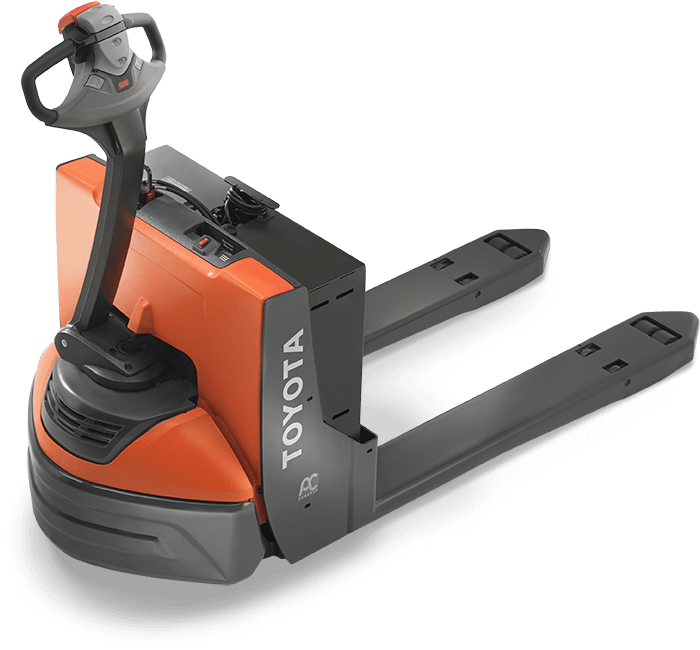

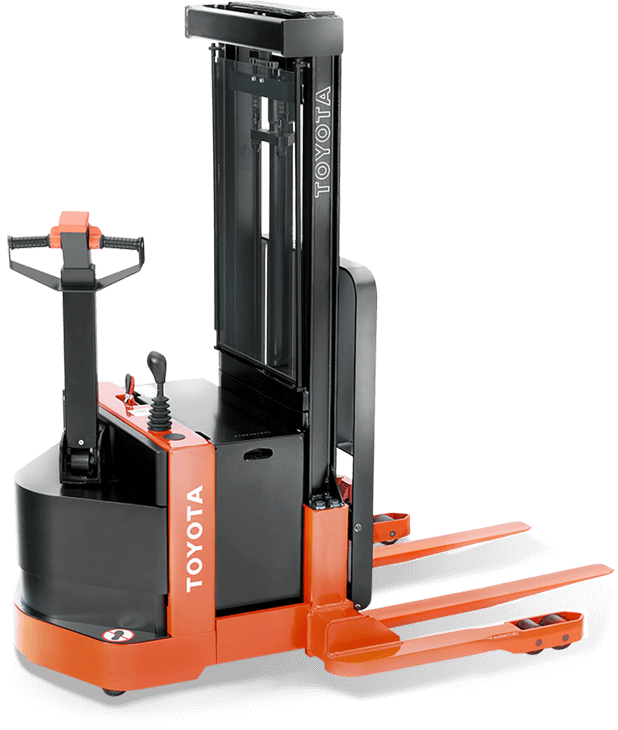

Whether you need an internal combustion forklift, an electric forklift or a narrow aisle solution for your warehouse, Toyota Nationwide Lift Truck’s financial experts and TICF can help. Let us develop a program for you, so you can focus on your operations – not on financing!

ADVANTAGES OF LEASING

Maximize Equipment Use – Leasing enables the customer to maximize the use of their equipment typically without paying for the full cost of ownership. Fixed leasing terms and payments give the customer the ability to forecast fleet replacement cycles. At lease termination, customers can return the equipment and replace with new equipment. There is no need to worry about selling the equipment or negotiating trade-in values.

Cash Management – Generally leases allow for little or no money due at lease signing as compared to financing the equipment through a retail agreement. Monthly lease payments will typically be lower than if the equipment are financed.

Capital Budget Constraints – Leases may allow customers an alternative to capital budget investments to obtain additional equipment.

Flexibility and Convenience – Leasing is a very flexible and convenient method of acquiring the “use” of equipment to meet the ever changing needs of the customer’s business. Depending on the lease agreement, various options to purchase or renew for an additional term at the end of the contract give the customer the flexibility to customize the lease structure to meet their needs. If the customer’s business needs change, the customer may arrange to return the equipment at the end of the lease or has the option to purchase.

Tax Benefits

Various tax benefits may apply for your leased equipment. (Please consult with your tax advisor for details).

Nationwide

Nationwide